By continuing use of this site you agree to use of cookies as per Privacy Policy

From instantly generating, to tracking and managing e-invoices, TallyPrime takes care of every little detail to bring you the most delightful experience.

| Tally is an ISO/IEC 27001:2013 certified GSP (GST Suvidha Provider), ensuring that TallyPrime directly integrates with IRP portal to seamlessly generate e-invoices. |

Instantly create e-invoices:Being a comprehensive software, generating e-invoices in a single click with TallyPrime is a seamless process.

Super-fast IRN integration:Automatically print IRN (invoice reference number) and QR code with TallyPrime

Direct IRP integration:Tally is a certified GST Suvidha Provider, which means your invoices can be directly uploaded to the IRP portal to generate e-invoices seamlessly.

Single or bulk e-invoice:For any business, generating invoices is a critical factor in remaining GST compliant. With TallyPrime, you can either create single e-invoice during voucher entry for a transaction or in bulk for multiple invoices together in a single click.

e-Invoice reports:As a business, having an overview of the invoices that you are generating is crucial. With TallyPrime, you can get e-invoice reports that provide a bird's eye view into all your e-invoicing tasks.

Supports offline export:Being a comprehensive software, TallyPrime allows you to carry out e-invoicing in the offline mode for instances of internet dysconnectivity, or in case you don’t want to send your invoice details directly to the portal. During such situations, you can export the details in JSON format and upload the same on IRP at your convenience.

E-way bill:Easily generate e-way bill for single invoice while recording invoice or multiple invoices from a report.

Multiple Invoice types :The software's built-in intelligence automatically generates various types of GST invoices like tax invoices, bill of supply, and e-way bills without re-entering details in the e-way bill portal.

Cancel IRN:Being a robust software, TallyPrime supports efficient management and cancellation of e-invoices. It also helps fetch IRN details from the portal to update your books.

Useful alerts:With TallyPrime's superior alert mechanism in case of accidental modification and redundancy, ensuring that you are in complete control.

GST return filing:With TallyPrime's prevention and detection mechanism, you can be assured that your GST returns are accurate.

Digital signed tax invoices:Be it tax invoices, bill of supply, generating e-way bills, you can do it all seamlessly with TallyPrime.

Online access to reports:Get access to a wide range of insightful business reports and access them from mobile or any device, from anywhere

Tally being a recognized and ISO certified GSP (GST Suvidha Provider), TallyPrime directly integrates with IRP portal to seamlessly generate e-invoices.

With a one-time setup, you can start generating and printing e-invoices within seconds. All you need to do is enable, record and print. TallyPrime’s connected solution will take of the rest.

Get your GST-ready TallyPrime Perpetual License for Rs. 18000 + 18% GST (INR 3,240). Call 1800-425-8859/ 91 80 25638240 for any queries. Take afree trial

What is e-invoices under GST?

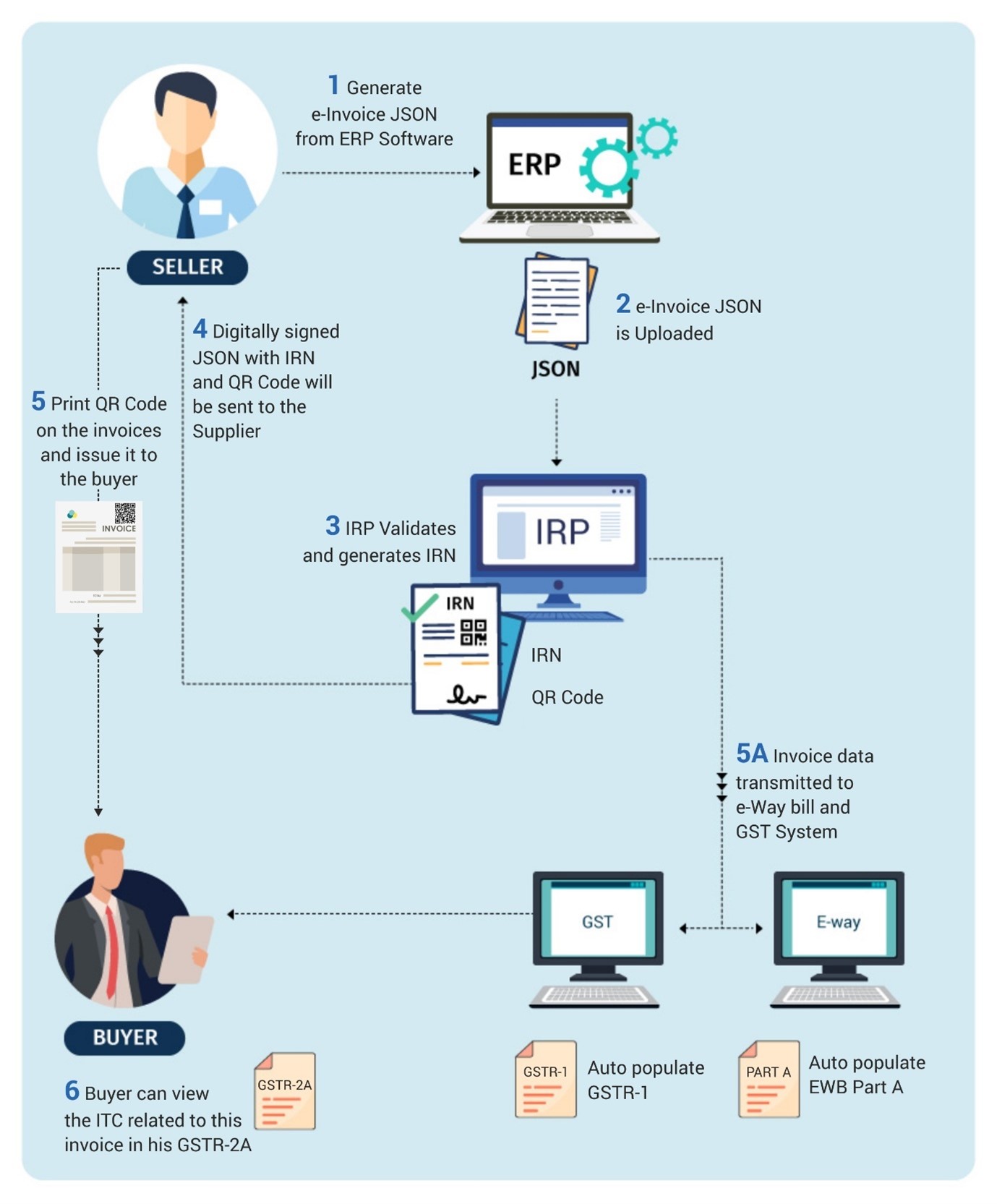

e-Invoice known as ‘Electronic invoicing’ is a system in which all B2B invoices are electronically uploaded and authenticated by the designated portal. Post successful authentication, a unique Invoice Reference Number (IRN) is generated along with QR code that needs to be printed on the invoice.

When will e-invoicing get implemented?

In the first, e-invoice was appliable from 1stOctober,2020 for business with a turnover of 500 crores . From, 1st January,2021e-invoicing is applicablefor businesses with an annual turnover of 100 crores, followed by 50 crores. Currently, it is applicable for businesses with turnover above 50 crores. From 1st October 2022 , e-invoicing will be applicable for businesses with a turnover exceeding 10 crores.

Who are eligible for e-invoice?

Electronic invoicing applies to all the businesses that are registered under GST and issues B2B invoices in a phased manner as notified by the Government.

Is e-invoicing mandatory?

Yes, it is mandatory for all the businesses who fall under the ambit of e-invoicing and need to issue an e-invoice for all B2B supplies.

Why e-invoice is required?

To standardize the format in which electronic data of an invoice can be shared with various systems in GST ecosystem ensuring the interoperability of the data.

What is the IRP in e-Invoice?

IRPis a designated portal designed to accept, validate and authenticate the invoice.

What is an IRN (Invoice Reference Number)?

IRN is known as “Invoice Reference Number” is a unique invoice number generated by the Invoice Register Portal (IRP) on uploading the invoices electronically.

Can IRN be generated in bulk?

Yes, you can upload the bulk invoices and generate IRN for each invoice that is uploaded. TallyPrime seamlessly supportsIRN generation for bulk invoices.

What are the types of documents reported under IRP?

Following documents are covered under the concept of e-invoice:

How does e-invoicing benefit businesses?

With the completeinteroperability of e-invoice datawith the GST system, it pre-populates the details in GST returns, e-way bill and reduce the reconciliation challenges. Alongside it also helps you to confirm the ITC eligibility via real-time visibility of invoices and eliminates fake invoices.